You’ve probably heard of your credit score but do you really know how it’s determined? Your credit score is a mysterious mix of factors that deem how “credit worthy” you are. This will impact what rates you get for car loans, mortgages, and credit card APRs. In some cases, it also affects where you are approved to live and how much deposit you have to pay for your utilities. Your credit score follows you throughout your life so it’s important to regularly monitor it. In this article, I’ll go over the breakdown of your credit score as well as managing your credit score.

Table of Contents

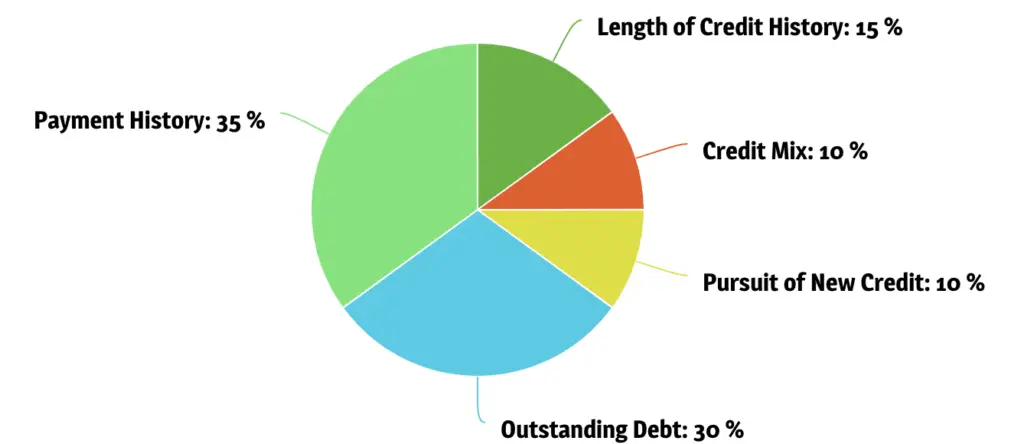

FICO Score Breakdown

FICO is the industry leader in the credit scoring industry. VantageScore is another competitor but since 90% of top lenders use FICO scores to make lending decisions, I’ll be going over FICO in this article. FICO scores are built around a variety of factors as illustrated below.

Payment History

Payment history is by far the biggest component of your credit score and is determined by you simply paying your bills on time. This includes bills such as credit cards, mortgages, and loans.

The easiest way to improve your score is to simply keep paying your bills on time. Unfortunately, the easiest way to ruin your score is by paying your bills late so make sure you’re always paying your bills in full on time. I highly recommend using auto pay so that you don’t forget about paying your bills. Payment history is the single most important factor for managing your credit score so make sure you’re paying your bills on time!

Length of Credit History

The length of your credit history is determined by a combination of the age of your oldest account, the age of your newest account, and the average age of all your accounts. I personally own 24 no annual fee credit cards but I don’t ever close any of the accounts even if they are unused because of this very factor. Once I close the card, that account will stop having an increase of length of credit history, taking a hit on my credit score.

You might have an annual fee card such as the Chase Sapphire Reserve that you don’t want to pay fees for anymore. Consider downgrading to the Chase Freedom Flex or Chase Freedom Unlimited in order to not close an account on your credit history.

Outstanding Debt

It’s always good to keep your outstanding debt low. It’s recommended that you keep your credit utilization under 30% and even below 10% if you want an excellent credit score. This means that you should only ever be holding a balance of 10% of your credit limit.

Your credit limit is the maximum outstanding balance you can have before being penalized. Many lenders and banks use your credit score to determine your credit limit when you apply for a credit card or line of credit.

Credit Mix

Having a good mix of credit is important for lenders to think you are reliable in handling different types of credit. The main two types of credit are revolving accounts, such as credit cards and retail store cards, or installment accounts, such as car loans, mortgages, and student loans. Having more than one credit card may or may not improve your credit score in ways such as lowering your credit utilization and showing that you can manage more payments. However, there’s no reason you should intentionally seek out an installment account if you don’t necessarily need it. It’s much more important to pay your bills on time and keep your revolving utilization low!

Pursuit of New Credit

Whenever you apply for new credit, a hard inquiry is put on your report. When lenders pull your credit report, a hard inquiry shows that you are actively seeking for credit. People who pursue new credit too frequently in a short period of time pose greater risk to lenders. Having too many of these may negatively impact your credit score. Make sure you’re not looking for too many lines of credit in a short period of time.

Each hard inquiry impacts your credit score for one year and stays on your credit report for two years. Make sure you keep this in mind if you’re looking to get the best interest rates on mortgage or a car loan in the near future.

If you check your credit score yourself or get pre-approved for an offer, you will put a soft inquiry on your report, which does not negatively impact your score. When you open a new bank account, most banks will only do a soft inquiry although some will do a hard inquiry, especially if you opted for overdraft protection.

Managing your credit score

I personally manage my credit score through Experian, but you can manage it through any of the three credit bureaus: Experian, TransUnion, or Equifax. You can get your credit report from each of these three agencies once per year for free at Annual Credit Report. This is the only place authorized to give you your free U.S. credit report as mandated by the FTC.

Your FICO credit score is a number between 300 to 850 and is rated based on these ranges.

FICO Score Ranges From Experian

| Credit Score | Rating | % of People |

| 300-579 | Very Poor | 16% |

| 580-669 | Fair | 17% |

| 670-739 | Good | 21% |

| 749-799 | Very Good | 25% |

| 800-850 | Exceptional | 21% |

Most missteps in your credit report will get taken off after a period of seven years. So make sure you’re always paying your bills on time and actively monitoring your credit!

How can I get credit if I have no credit or bad credit?

If you have no credit history or bad credit history, it’s difficult to be approved for new lines of credit. However, there are some workarounds to this.

Have a co-signer or become an authorized user

Have a family member or close friend be a co-signer with you when you’re applying for credit or be an authorized user on their own line of credit. Your co-signer will be 100% responsible for your debt as well as take a credit score hit if you don’t pay on time, so use it responsibly. Many parents add their children as authorized users on their credit cards to kick-start their credit history as well.

Secured credit cards

Secured credit cards are usually backed by a security deposit equal to your credit line. This protects you if you happen to default and can help you build your credit score if you started with bad credit. As you pay your bills on time, your issuer will report your payment history to the credit bureaus and your credit score will improve.

College credit cards

College credit cards are usually very forgiving of no credit history. A great one I used in college (and still use now) is the Discover It. This card gives you great rewards and even a $20 statement credit each year with a GPA of 3.0 or higher. You can read about that here.

Conclusion

Managing your credit score is can seem daunting but it’s easier than it seems! Pay your bills on time, have a couple lines of reliable credit, and keep your utilization low and you’ll be well on your way to a great credit score in just a matter of time.

Like this post? Check out other posts like it here. Comment below or please subscribe to get notified of the latest posts! I really appreciate it.

Hello, I’m Chloe! I’m the primary author of Off Hour Hustle. Currently, I work as a software engineer, sell products through eBay, Etsy, and OfferUp, have 26+ credit cards, and am always working to diversify my income streams. In my spare time, I enjoy climbing, hiking, and other outdoor activities.