Who wants to be a millionaire? With the beauty of time, compound interest, and a Roth IRA, you can become a millionaire at retirement, completely tax free! A Roth IRA is singlehandedly the most important investment you can have after you set aside money for your expenses. emergency savings, and 401k match from your employer. With an optimized Roth IRA return, you can become a millionaire too.

Table of Contents

What is a Roth IRA?

Many people know about their employer sponsored 401k plan but a lot of people neglect to acknowledge the immense capabilities of a Roth IRA. While the 401k may be limited to specific funds based on your plan’s sponsor, a Roth IRA has much more flexibility in asset selection than the 401k. A Roth IRA can also be opened by anyone with any sort of employment income, regardless of age. This means that if you have kids who are under 18 years of age but are earning income with a job, you can open one for them too! Rental income, dividend income, pensions, annuity income, interest, or capital gains don’t count as employment income so those funds cannot be contributed to your Roth IRA.

Roth IRA Contributions

You can contribute $6000 per year into your Roth IRA and $7000 if you are age 50 or older. There are limitations to how much you can contribute so make sure you start contributing early in your career to make the most out of its capabilities.

| Single, Head of Household, or Married Filing Separately and you did not live with your spouse at all during the year | < $125,000 | $6000 $7000 if age 50 or older |

| >= $125,000 and < $140,000 | A reduced amount | |

| >= $140,000 | Zero | |

| Married Filing Separately and you lived with your spouse at some point during the year | < $10,000 | A reduced amount |

| >= $10,000 | Zero | |

| Married Filing Jointly or Qualified Widower | < $198,000 | $6000 $7000 if age 50 or older |

| >= $198,000 and < $208,000 | A reduced amount | |

| >= $208,000 | Zero |

If you’re married, you can also make a contribution for your partner if your partner makes little or no income. The couple must be filing a joint tax return with eligible compensation. This is a great way to get double Roth IRA return tax benefits!

You can always make contributions to your Roth IRA for the previous year (in today’s case, for 2020) up until tax day of the current year. This means that on January 1, 2021, I can contribute $6000 for the year of 2021 but I can also still backfill and contribute for my 2020 limit if I hadn’t done so yet. Make sure that if you haven’t contributed to your 2020 amount, you do that before tax day comes in April!

You can invest your Roth IRA in anything from stocks, funds, bonds, and more. A Roth IRA return gives you tax benefits when you withdraw by giving you tax free earnings. These are from post tax dollars, meaning that you’ve already paid tax on them during the year you earned them. Make sure you note that you can only withdraw your earnings once you hit 59.5 years old or you’ll pay a fine.

One specific way you can contribute to your Roth IRA if you make above the income limit is the Backdoor Roth IRA. I will be discussing this in a future post!

Qualified Distributions

The only exception to withdrawing your Roth IRA earnings whenever you want and tax free is through Qualified Distributions:

- If you’re 59.5 years old or older.

- The withdrawal is used to purchase your first home or the first home for a qualified family member. This is limited to $10,000 for your entire life.

- You become disabled.

- The funds are distributed to the beneficiary after a Roth IRA holder passes away.

With Qualified Distributions, you can withdraw earnings at anytime. You can also always withdraw the initial capital you deposited ($6000 per year) with no penalties. You can basically think of a Roth IRA as a savings account with benefits of being able to earn in the market. Qualified Distributions are especially beneficial for when you want to buy your first home!

Contributing to Maximize Your Roth IRA Return

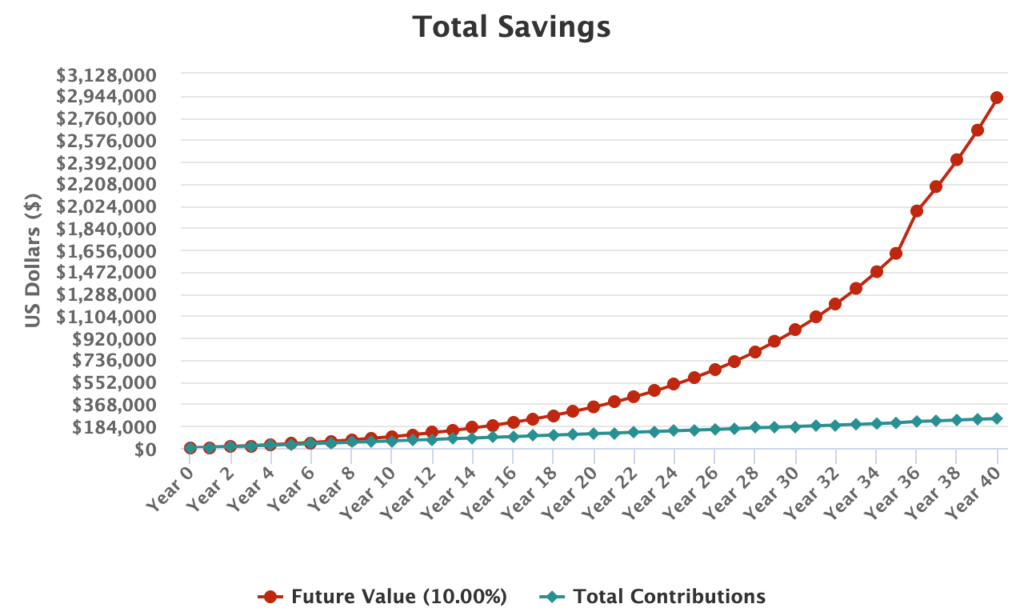

I can’t stress this enough but the single biggest factor that grows your money in the market is time. Simply investing a couple dollars today will multiple exponentially in the future. Let’s analyze an example. Pretend we started investing into our Roth IRA at 25 years old. According to historic returns, the S&P 500 Index has returned 10% annually. Now if we invested $500 per month into our Roth IRA, which is equal to $6000 per year, we would have $1,626,146 at age 60 in our Roth IRA. That’s not including all the other assets your would have that contribute to calculating your net worth!

You can invest your Roth IRA in individual stocks or funds and redistribute your holdings whenever you want without paying any capital gains tax. I recently sold some of my PYPL holdings and reinvested in VISA and AAPL. If you’re worried about the current state of the market, you can even sell your holdings and keep your Roth IRA in cash as long as you don’t withdraw and invest later without paying any taxes.

If you want your earnings to have a relatively steady increase without much risk you can invest in funds such as the Vanguard Total Stock Market Index (VTSAX) and Schwab Total Stock Market Index (SWTSX), which are low cost total stock market index funds. These are good for people who wish to hold a diversified portfolio, as they track nearly the entire U.S. stock market in one fund. If you want a more aggressive but high risk approach, you can invest in individual stocks.

Opening a Roth IRA

There are many brokers or robo-advisors you can open your Roth IRA with. I personally use Vanguard for its low costs, but there are many other brokers out there as well. SoFi in particular has 0% fees and a $0 minimum for both active investing and robo-advisor investing. And if you use my link you get $50 in stocks after funding an active investment portfolio for a Roth IRA or an individual brokerage account. 🙂

So what are you waiting for? If you don’t have a Roth IRA, open one today! Use your Roth IRA return to streamline your savings for retirement. If you haven’t contributed to your 2020 or 2021 funds, do that asap. And let’s all learn how to behave like a millionaire and grow to be Roth IRA millionaire as well.

Check out my previous posts and please subscribe if you enjoyed my content. I really appreciate it!

Hello, I’m Chloe! I’m the primary author of Off Hour Hustle. Currently, I work as a software engineer, sell products through eBay, Etsy, and OfferUp, have 26+ credit cards, and am always working to diversify my income streams. In my spare time, I enjoy climbing, hiking, and other outdoor activities.

As a CPA I believe that Roth’s are wonderful. This is a great breakdown to bring awareness to the benefits of a Roth.

Wonderful breakdown! Very thorough. Thanks for sharing 🙂