Have you ever been promised 3% return on groceries from your credit card but only received 1%? Or maybe you purchased fast food at a gas station and your credit card categorized it as gas? I’ve had this happen to me way too many times. Merchant category codes are what determine what category your spending falls under. These codes are how I maximize rewards with my no annual fee credit cards. What are merchant category codes and how do they work?

Table of Contents

What is a merchant category code?

A merchant category code (MCC) is a four digit number that the four major credit card networks (Visa, Mastercard, Discover, American Express) label each business that accepts credit cards. These codes are used to track your purchases. They’re how each credit card network “knows” what kind of item you are purchasing.

Why are MCCs used?

One of the main reasons MCCs are used is for business tax purposes. Depending on what category a business falls under, they may qualify for certain exemptions. They are also used in categorizing your purchases. If you purchased a coffee at a department store, your purchase will be categorized as a department store regardless of what you purchased.

Where can I find my MCC?

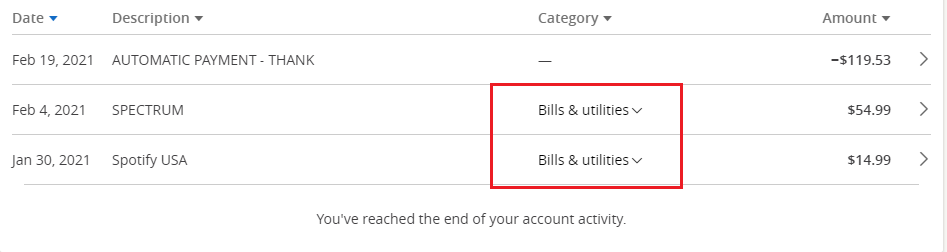

You can find this code for each purchase on your credit card statement. Your statement might not show the specific four digit code for each merchant, but it will show the category in which it was classified which is enough to see if you got rewards for a certain category. Here is an example from my Chase Freedom Flex. This shows Bills & utilities as my merchant category code for the past two purchases. This is great because the current category for 5% is bills & utilities!

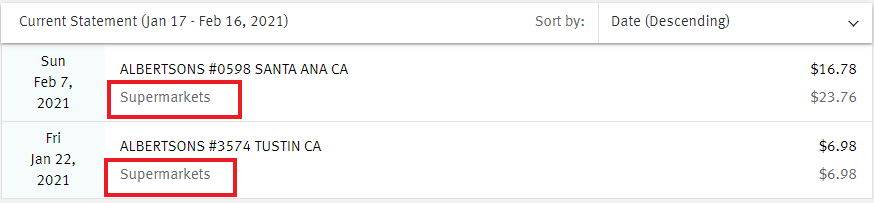

And here’s another example from my Discover It. This shows Supermarkets as my merchant category code for the past two purchases. The current 5% category for Discover It is grocery stores!

Merchant category code variations

Many merchant category codes are straight forward but others are not. For example, Albertsons is clearly a grocery store. IHOP is clearly a restaurant. Different businesses have varying codes for each credit card network. However, these codes can vary across stores, counters, and locations.

Different credit card networks have varying merchant category codes

It’s possible for the different credit card networks to have different merchant category codes for the same business. You can find the list of merchant category codes from popular merchants such as Visa. Visa has their own supplier locator in which you can search for merchant category codes.

Some networks don’t have their merchant category codes publicly available. For these networks, you can either contact them for a list or actually purchase something and then look at your credit card statement for your item’s categorization.

Stores can have different merchant category codes among locations and counters

A store such as Costco could have different merchant category codes at their pharmacy, checkout register, gas station, and food court. The codes may also differ when you’re at self checkout at a CVS vs. at a checkout counter. Make sure you’re checking for the MCC at where you are actually making the purchase to maximize your cash back rewards.

Maximizing your cash back with credit card purchases

Now that you know all about merchant category codes, how can you use it to your advantage to get maximum cash back?

Research your stores before making big purchases

Knowing your merchant category code before you make a big purchase can be the difference between saving a couple hundred to thousand dollars per year, which adds up. For example, if you’re making a $2,000 TV purchase at Costco, knowing Costco’s merchant category code can be the difference between receiving 5% or 1% cash back ($100 or $20).

Get creative with your spending

If your credit card is offering you 5% back on grocery stores, you could buy a gift card for a store you were going to shop at anyway at that grocery store. This way, you will receive 5% back on the cash you spent at that grocery store and still have the full amount you spent on a gift card.

There are also times when the Chase Freedom Flex or Discover It have PayPal as their 5% cash back rotating category. When this happens, you can link your credit card to your PayPal and send money to yourself while paying the 3% credit card fee to get a 2% return for free!

Conclusion

Merchant category codes are good to know about and even more important to understand when you’re making a big purchase. Make sure you do your research before you make your purchases, every little amount adds up!

Did you enjoy this article about how to maximize your credit card rewards using merchant category codes? Check out other posts like it here. Comment below or please subscribe to get notified of the latest posts! I really appreciate it.

Hello, I’m Chloe! I’m the primary author of Off Hour Hustle. Currently, I work as a software engineer, sell products through eBay, Etsy, and OfferUp, have 26+ credit cards, and am always working to diversify my income streams. In my spare time, I enjoy climbing, hiking, and other outdoor activities.

I had no idea merchant category codes where even a thing! I’ll definitely be keeping my eyes out for this now. Thanks!