In my previous blog post, I talked about how I optimize returns on purchases with various credit cards. In this post, I’ll share with you the apps I use that earn me passive cash back on top of these credit card returns. I’ve used these apps for several years and haven’t touched them except to link new credit cards or cash out!

Rakuten – Cash back at 2500+ stores

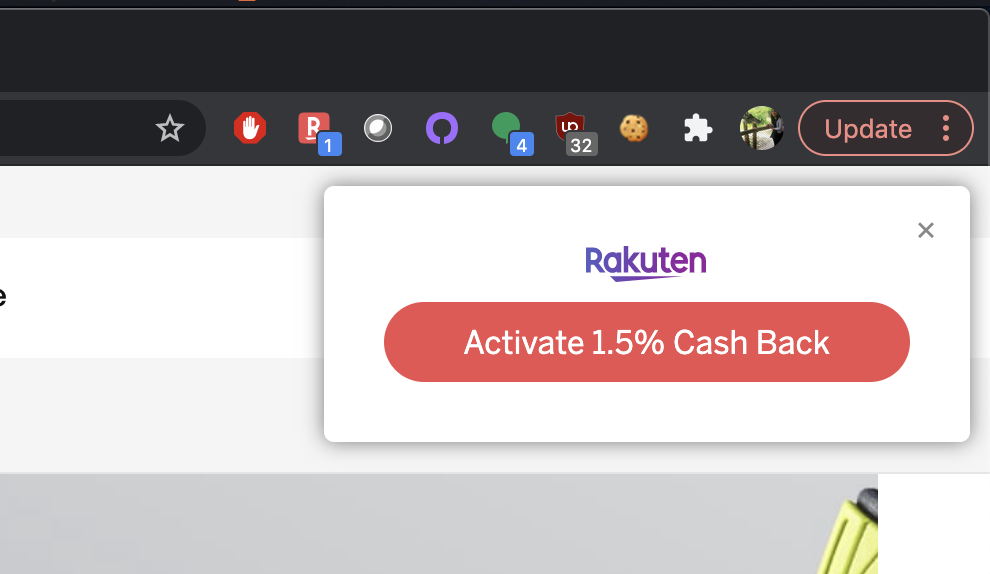

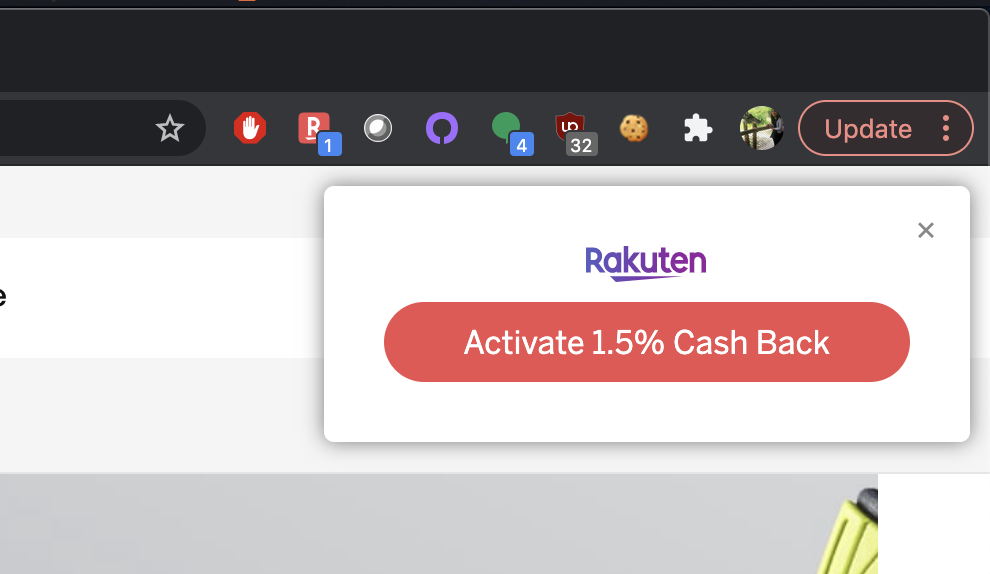

Rakuten is great for all online purchases and the best application for passive cash back. You can either shop through their website or download the Chrome extension. I personally prefer the extension as it reminds you whenever you go on a website by showing a small pop up to activate and receive a percentage back. This stacks on top of all your credit card bonuses and other bonuses. If you’re shopping on mobile, then remember to download the Rakuten app and shop through that portal. The example below is how the popup shows on desktop.

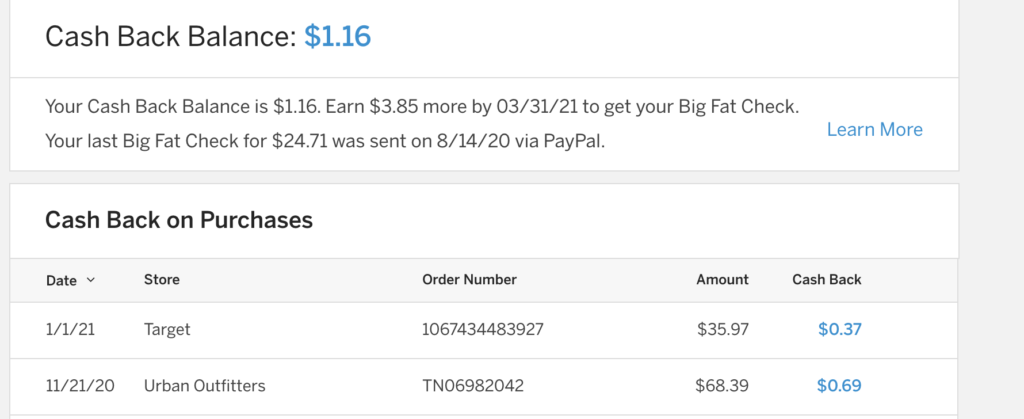

Rakuten pays out once a quarter and you can choose to receive cash back via PayPal or get a check in the mail. If your balance is under $5, your cash back will roll over to the next quarter instead. Here’s the payout schedule for each quarter.

| Quarter | Payout Date |

| Jan 1 – Mar 31 | May 15 |

| Apr 1 – June 30 | Aug 15 |

| July 1 – Sept 30 | Nov 15 |

| Oct 1 – Dec 31 | Feb 15 |

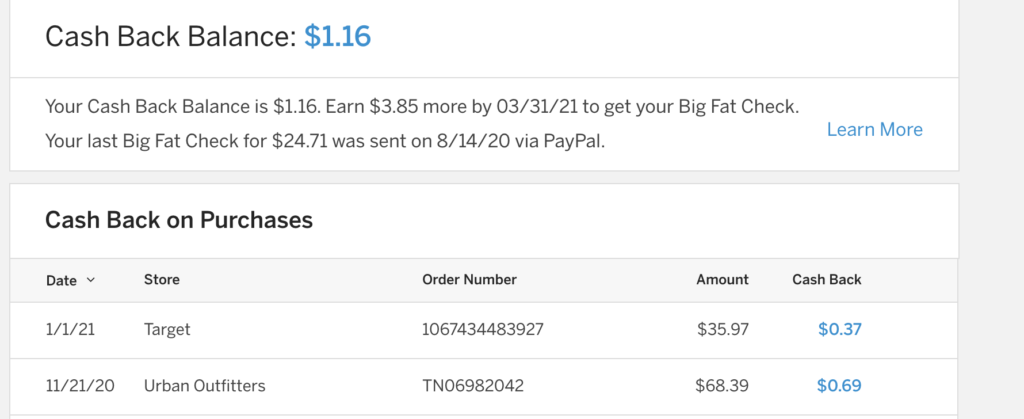

These are my most recent purchases via Rakuten and my current cash back balance! Rakuten is my favorite when it comes to getting passive cash back on online purchases because they partner with so many of my favorite stores such as Nike, Lululemon, Target, Walmart, and more! Sign up for Rakuten with my link, use my referral code CHLOEC491, and get $20 after your first purchase here.

DOSH – Automatic cash back when you shop, dine, or book hotels

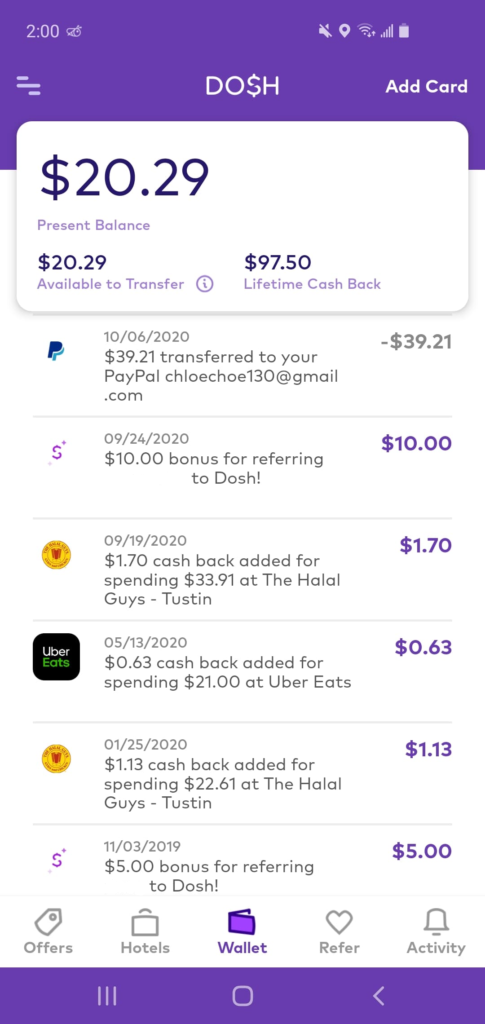

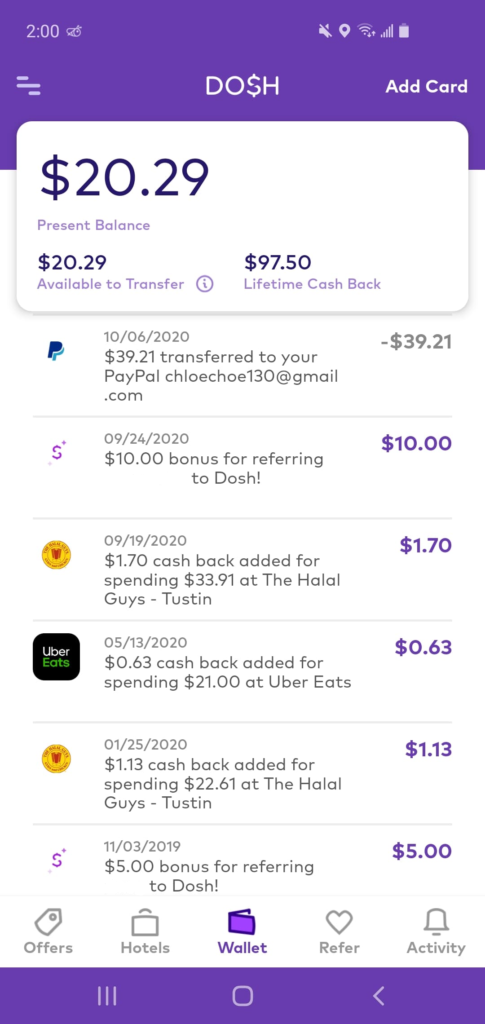

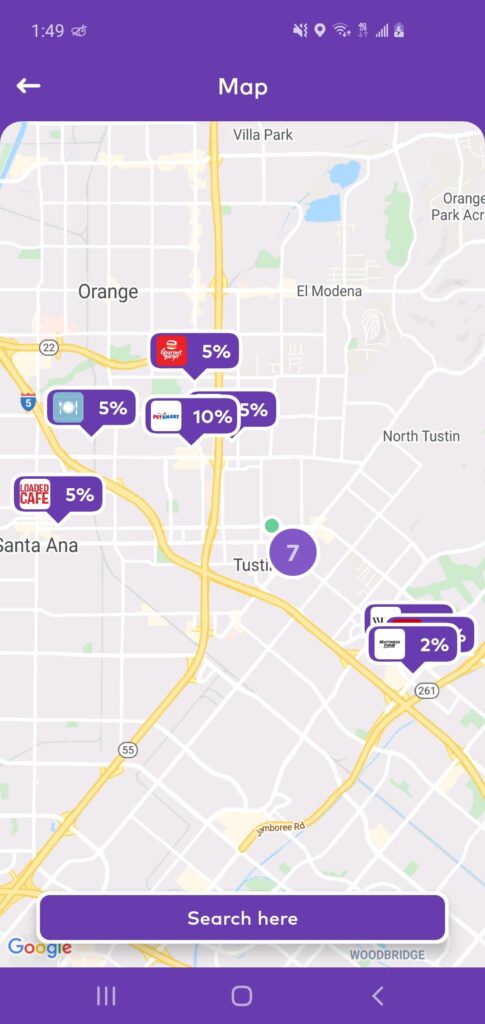

DOSH gives you passive cash back for any purchase made with your linked credit cards. I’ve seen partnered merchants offer between 1-10% cash back on purchases. Just download the app, link your credit cards, and watch your cash back go up whenever you make a purchase at qualifying stores! Popular places that I usually go to include McDonald’s, Halal Guys, Sephora, Office Depot, Express, and Forever 21.

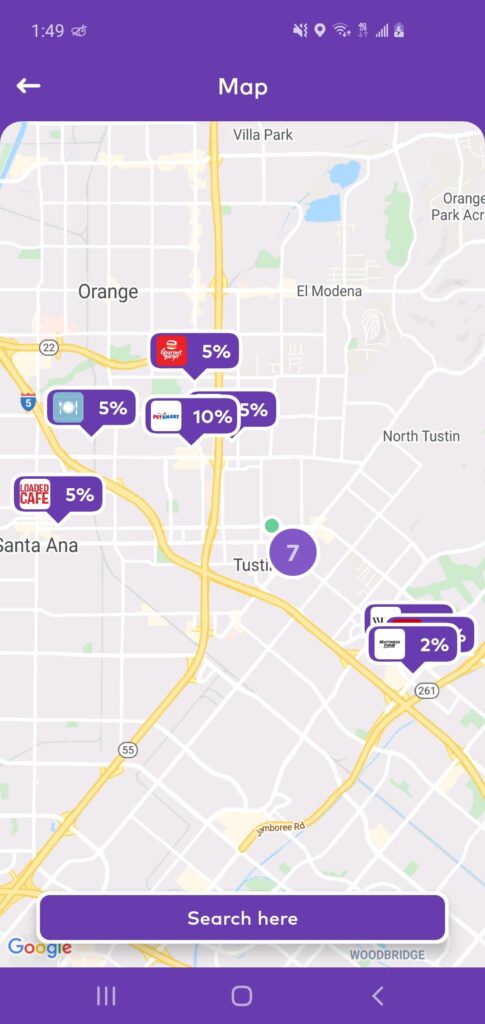

DOSH includes online and in-person offers but I prefer to simply use the in-person offers and use Rakuten for online, as that makes this app 100% passive cash back. Online offers will not stack with Rakuten as you have to activate a session for DOSH via the app, so I would recommend with sticking to Rakuten for online purchases and DOSH for in person. Minimum cash out balance is $25 and this is cashed out to your PayPal account whenever you like. You can see nearby offers by searching by location or you can search by store name as well. Sign up for DOSH here, use code CHLOEC4, and get $1 back after linking a credit card and making your first purchase.

CashApp – Send, spend, save, and invest (Honorary Mention)

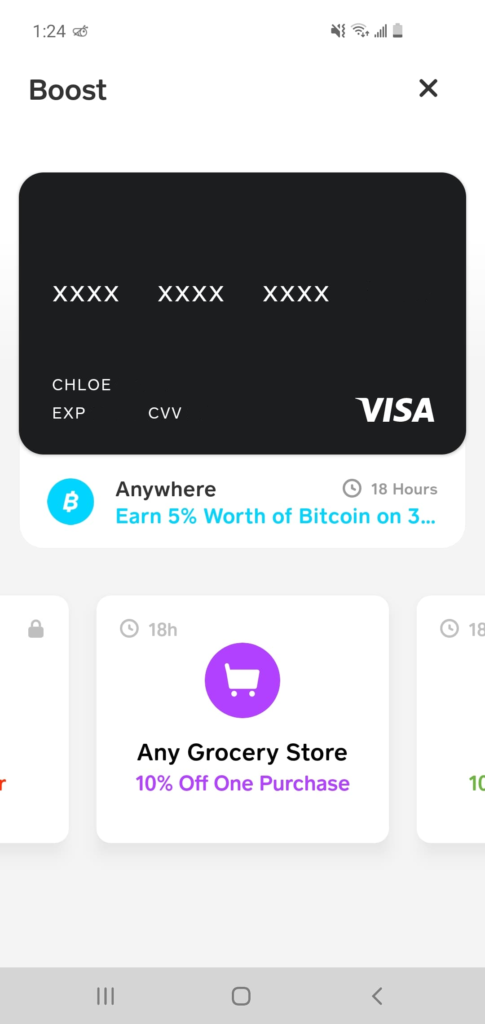

CashApp is the P2P payment app owned by Square. This one is a little less passive but it’s definitely an app to keep around. You can get anywhere from 5-50% back from stores on this app. At the time of writing, you can get 5% in Bitcoin on any three purchases, 10% back at any grocery store, 10% off at Starbucks, 20% off at USPS, 10% off at Chick-fil-A, 10% off at Taco Bell, and more. I’ve seen other stores like Lululemon, Nike, Home Depot, Etsy, and others. You get the idea–it has a lot of popular stores. 🙂 I use the 5% back in Bitcoin anytime the offer is there as well as the grocery store one very often.

This is less passive because you have to apply for the debit card, which is similar to the Venmo debit card but you also have to activate the respective “Boost” you want to use. I always carry this card around and when I know I’m spending at one of those places, I just add cash (the deposit is instant), activate the boost, use the card, then cash back out right away. If you’re good about remembering, this card is awesome.

Here’s a screenshot of what the interface looks like. Right now, I have the 5% back in Bitcoin boost activated, which is displayed right under the card. You can see other offers, such as the 10% back at any grocery store underneath. When you use this card in stores, you’ll see that you paid the full amount on your receipt but on the CashApp interface, you’ll see that you spent xx% less. Sign up for CashApp here and use code BMCTVVT for an extra $5 when you send money for the first time!

Passive Cash Back – Conclusion

And that’s it! These are the main apps I use for cash back on top of rewards from my credit cards and it’s honestly great because there’s almost no work to be done for them. With this on top of credit card returns and churning (which I’ll cover in a future blog post), I definitely average around 15-20% return on all my purchases.

Check out my previous blog post for how I stack these and optimize for maximum cash back with my credit cards! In my next post, I’ll be talking about how I approach the minimalist lifestyle and save and make money while doing it!

Did you enjoy this article about the best passive cash back apps? Subscribe here to be notified of the latest blog posts. What other financial topics do you want to hear about in the future? Leave a comment below!

Hello, I’m Chloe! I’m the primary author of Off Hour Hustle. Currently, I work as a software engineer, sell products through eBay, Etsy, and OfferUp, have 26+ credit cards, and am always working to diversify my income streams. In my spare time, I enjoy climbing, hiking, and other outdoor activities.