The Venmo credit card was recently released on October 5, 2020. I was super excited about this card because it touted to track your purchases and reward you with cash back for the categories you spent the most on. How can it get any better than that? I applied and got approved for the Venmo credit card on December 21, 2020. Here’s my thoughts and review on this card!

Table of Contents

Overview

Venmo is a peer-to-peer payment platform that launched publicly in March 2012. They’ve since gone through a myriad of changes and most recently launched their credit card. The Venmo credit card is a no annual fee credit card with no foreign transaction fees.

Dynamic 3-2-1 Rewards

This card tracks your spending every month and rewards you with 3% cash back on your top spent category, 2% on your second, and 1% on the rest. However, there is a catch. Venmo only rewards 3% or 2% on these following merchant category codes:

- Dining & Nightlife

- Travel

- Bills & Utilities

- Health & Beauty

- Grocery

- Gas

- Transportation

- Entertainment

All other categories will default into the 1% category. This was slightly disappointing to me as I already get 3% or more in many of these categories with my other credit cards. However, the bills & utilities category as well as the health & beauty are two categories that aren’t very common among other credit cards. I’ll probably be using this card for my bills & utilities to get 3% back on those payments.

Rewards Redemption

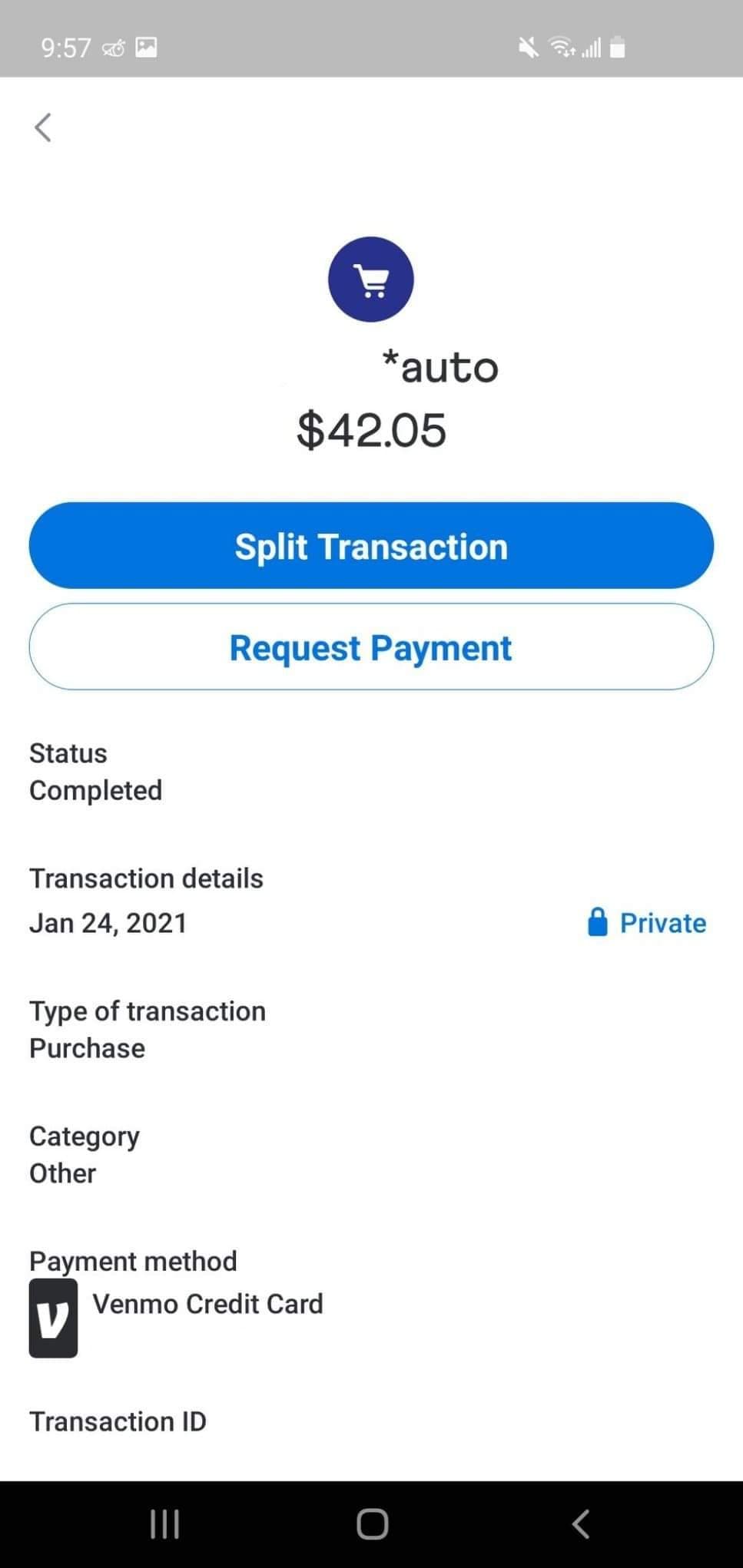

I did a test run with the Venmo credit card with my car insurance. This category didn’t fall into any of the qualifying merchant category codes so I only received 1% cash back.

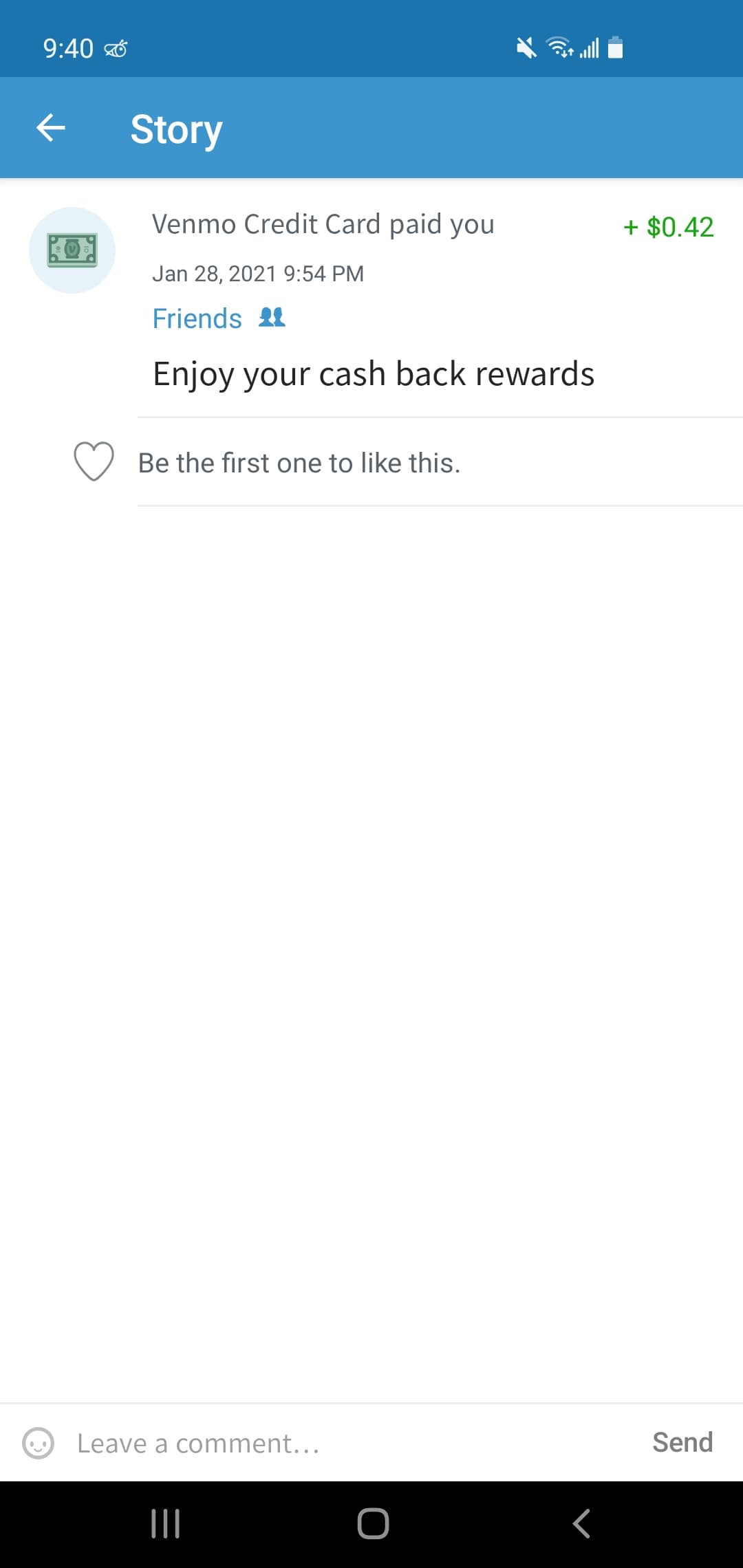

Venmo sends you this cash back via their P2P payment platform even before you pay your bill. I got my cash back within four days for my purchase.

You’ll receive 3% and 2% cash back in your top spent categories for up to $10,000 annually, which is calculated from your approval date. Everything you spend excess of $10,000 will give you 1% cash back.

Credit Card Packaging

Usually I wouldn’t care about credit card packaging but this one was the only card out of the 24 credit cards I have that came with nice packaging! The credit card comes with pretty fancy packaging compared to the dull paper envelopes that other credit cards come with.

Venmo offers five vibrant colored designs. Depending on the color you chose, the exterior packaging will differ as well. I chose pink!

Personalized QR Code

The card front itself is a personalized QR code, which is an interesting spin for credit card designs. You scan it to get directed to Venmo to activate your card or your friends can scan it to send you payments.

Integration With the Venmo App

Your top spending categories are calculated at the end of every pay period. Cash is then sent to you via the Venmo app. This is great because you don’t have to wait for a minimum balance in order to cash out like a lot of other credit cards.

The Venmo app tracks your credit card activity in real time and allows you to split bills with your friends smoothly. While these aren’t game-changing features, with already 40 million users on the platform as of the beginning of 2019, the familiarity of the app is a big selling point for the credit card. Users who are familiar with the Venmo experience and frequently use the platform will find using the credit card a seamless experience.

Conclusion

For most day to day purchases, the Venmo credit card is great for someone who wants one card and doesn’t want to manage rewards categories. While this isn’t a premium card with perks like the Chase Sapphire Reserve, it is a solid no annual fee credit card with no foreign transaction fees for the every day spender.

Did you enjoy this article on the Venmo credit card? Check out other posts like it here. Comment below or please subscribe to get notified of the latest posts! I really appreciate it.

Hello, I’m Chloe! I’m the primary author of Off Hour Hustle. Currently, I work as a software engineer, sell products through eBay, Etsy, and OfferUp, have 26+ credit cards, and am always working to diversify my income streams. In my spare time, I enjoy climbing, hiking, and other outdoor activities.