Want to make regular income aside from your 9-5? Sell covered calls on Robinhood or any other platform for monthly income. Selling covered calls is an options strategy that minimizes your risk with options. You can own your stocks and watch them grow while collecting income by selling covered calls on Robinhood and collecting the premiums.

Not sure what options are? Want to learn how to utilize them into your investing strategy? Keep reading to learn more about how to sell covered calls on Robinhood!

Note: If you’re a beginner with investing in the stock market, read this article about investing for beginners first!

Table of Contents

What Are Options?

Options are contracts that allow the buyer the opportunity to buy or sell stocks at a certain price after paying a premium for that contract. There are two types of options: calls and puts.

Calls: Calls are a type of option contract that allows you to buy 100 shares of a stock at a certain price before expiration.

Puts: Puts are a type of option contract that allows you to sell 100 shares of a stock at a certain price before expiration.

The price at which you can buy or sell your shares is called the strike price. Each option also has an expiration date which is the date by which the owner has to exercise their options or they expire worthless.

In this article, I will be going over how to sell covered calls on Robinhood. I’ll be going over other options strategies in future articles so stay tuned!

What Are Covered Calls?

A covered call is an options trade in which the investor selling the call option actually owns 100 shares of the underlying stock. When you sell covered calls on Robinhood, you are collecting the premium from buyers so that they have the right to buy shares from you. This way, you are “covered” in the chance that the option is exercised and does not have to buy 100 shares of the stock to sell it to the contract buyer.

An option will be assigned and exercised by the buyer if at expiration, the call option is above the strike price. This means that you’ll have to sell your shares to the buyer at the strike price and keep the premium.

Covered calls are a popular options strategy because of the ability to generate passive income in the form of premiums. It’s ideal for investors that believe that the price of the underlying equity won’t increase much in the long run but still want to generate income on top of the growth and dividends of their shares.

Keep reading to learn about the steps required for you to sell covered calls on Robinhood.

Get Approve for Options on Robinhood

Options trading requires a level 2 account on Robinhood. Because options trading is inherently risky, you will need to show Robinhood that you have some experience with trading before getting approved.

Steps to Get Approved for Options on Robinhood

- Create a Robinhood account! If you don’t have one, you can sign up for one (and get a free stock) with my link.

- Click on the person icon on the bottom right (on mobile) and then click on “Investing.”

- Scroll down until you see “Options Settings” and then sign up for Level 2 Options Trading. This will allow you to buy calls and puts, sell covered calls, sell cash-covered puts, and exercise options.

- Answer a couple questions related to your trading and investing experience.

- Wait for approval! Some accounts may get approved instantly and some may go under review.

How to Sell Covered Calls on Robinhood

For the sake of this article, I’ll be demonstrating how to sell covered calls on Robinhood. However, you can sell covered calls on any other platform if you get approved.

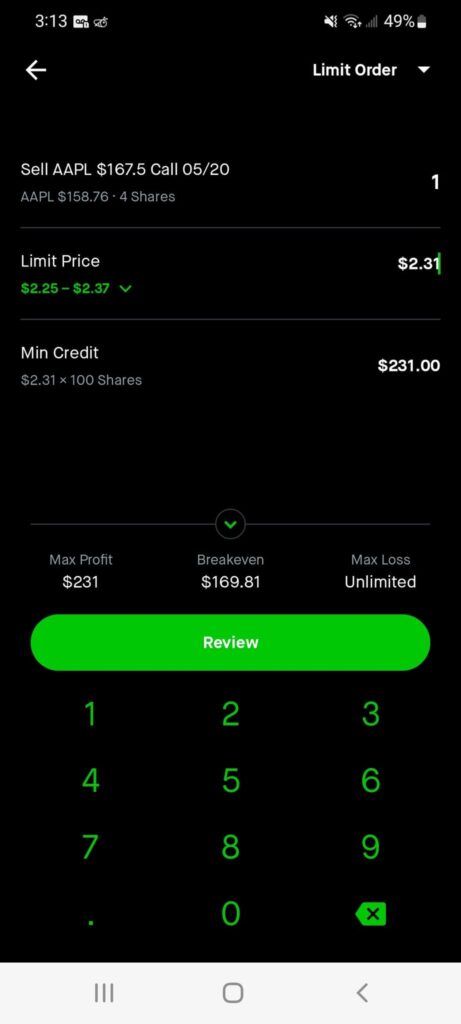

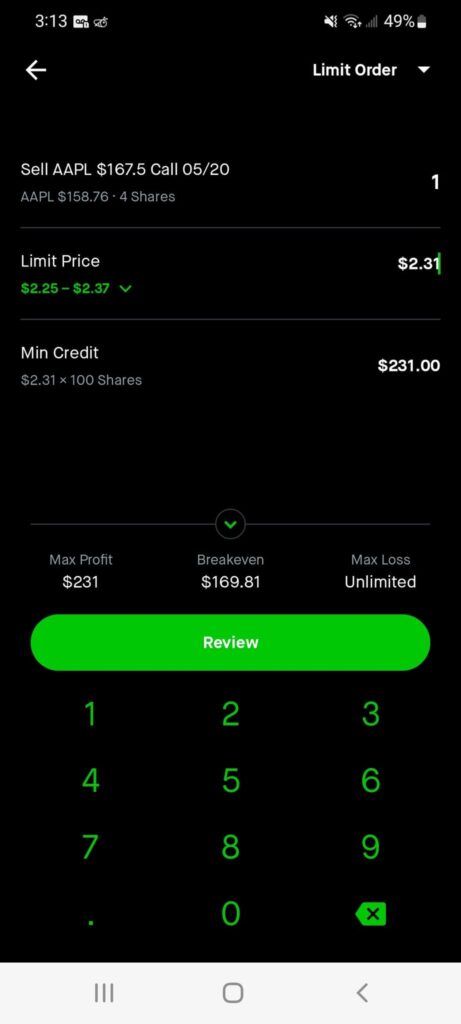

In order to sell covered calls, you have to own 100 shares per contract you sell of the underlying stock. In my example, I own 100 shares of AAPL and will be selling a covered call with a $167.50 strike price, 05/20 expiration date, and for $2.31 per share, which equates to a $231 premium. If at 05/20, the price of AAPL is above $167.50, I may be assigned to a buyer and have to sell 100 shares of AAPL at $167.50 per share. I still get to keep my $231 premium.

You can see an example of this below. The “Max Profit” shows how much premium you can make, not counting the amount you get from selling your shares. The “Breakeven Point” shows what price AAPL will have to be higher than in order for you to potentially sell your shares for less than you could make if you kept them. “Max Loss” shows unlimited because theoretically, AAPL could become a million dollars by the expiration date. This is why you “cover” yourself by already owning 100 shares of the asset so that you don’t have to buy 100 shares to sell it immediately at the strike price to your buyer.

The limit price of each share on Robinhood for this contract ranges from $2.25 to $2.37. This a recommended limit range and the lower the price you sell your contract for, the more likely you are to get assigned a buyer to pay you a premium.

Best Stocks for Covered Calls

The best stocks for covered calls are stocks that you are anticipating will be relatively stable or have a downwards trend in the short-term.

It’s important to note that the further out the expiration date, the more premium you can collect because there is more time for the strike price to be hit. The higher the strike price, the lower the premium amount will be because the price of the underlying asset is less likely to reach the strike price.

Covered Calls vs. Long Calls

Covered calls, as mentioned before, is when you have 100 shares of the underlying equity (per contract) to cover yourself in case the option contract you sold is exercised. This means that you won’t have to buy 100 shares of an asset and sell it at your strike price right away since

A long call is when you expect the underlying equity to go up. If the asset is above the strike price before expiration, you can exercise the option and earn profits equal to the difference of one share of the price and your strike price (times 100 per contract) minus the premium you paid. You can also sell the call option for a higher premium than you got it for (because the equity is closer to the strike price) to reap profits.

How to Sell Covered Calls on Robinhood – Summary

Selling covered calls on Robinhood is a great way to make passive income. If done strategically, you can keep your shares for growth and make a constant stream of income by selling contracts. What do you think? Will you start selling covered calls on Robinhood? Comment below!

Did you enjoy this article on how to sell covered calls on Robinhood? Read more articles like it here and subscribe to be notified of the latest posts!

Hello, I’m Chloe! I’m the primary author of Off Hour Hustle. Currently, I work as a software engineer, sell products through eBay, Etsy, and OfferUp, have 26+ credit cards, and am always working to diversify my income streams. In my spare time, I enjoy climbing, hiking, and other outdoor activities.